What is Financial Leverage and Why is it Important?

Content

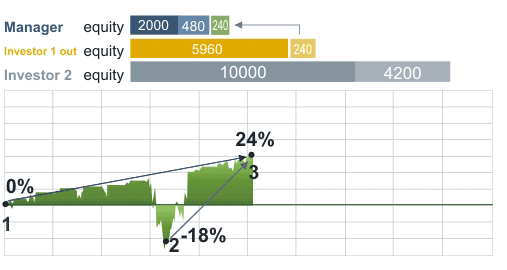

At the end of the year, your portfolio is 18% up year-to-date — an impressive result. While beneficial at times, prolonged exposure to high leverage is asking for trouble. De-leveraging quickly can save you from one of the biggest investors’ nightmares — being right but too early. Just like a bank will charge you an interest rate for a loan, the broker will charge you fees for using leverage. Be sure to check the fee structure before using leverage. Although leverage allows you to multiply the profits, it multiplies the losses too.

Performance information may have changed since the time of publication. Using leverage gives professionals more flexibility in directing the money they have to invest. With leverage, they can drastically increase their purchasing power and potentially invest in more companies at one time using smaller amounts of cash and larger amounts of debt. Leveraged ETFs are self-contained, meaning the borrowing and interest charges occur within the fund, so you don’t have to worry about margin calls or losing more than your principal investment. This makes leveraged ETFs a lower risk approach to leveraged investing.

Vehicle loans

Trade #Starting Account Balance# Lots of UsedStop Loss Trade ResultEnding Account Balance1$ $60$4402$ $120$3203$ $60$2604$260350Margin Call$150A four-trade losing streak is not uncommon. Experienced traders have similar or even longer streaks. You’ve just lost 27% of your account ($120 loss/ $440 account). You’ve just lost 12% of your account ($60 loss / $500 account). If he knows what he’s doing, it doesn’t matter if his opponent is Arnold Schwarzenegger, due to the leverage that his forearm can generate, he’ll usually come out on top. Learn about crypto in a fun and easy-to-understand format.

‘Leverage: Redemption’: Keith David Breaks Down Major Character Connection to [Spoiler] – TV Insider

‘Leverage: Redemption’: Keith David Breaks Down Major Character Connection to [Spoiler].

Posted: Wed, 07 Dec 2022 08:00:00 GMT [source]

Whether a givendebt is good or bad depends on several factors. There’s the interest rate and the amount of time it will take you to pay back the loan. Then there’s the matter of what you’re borrowing the money for. Equally important to consider is your unique tolerance for debt. Able Company uses $1,000,000 of its own cash to buy a factory, which generates $150,000 of annual profits.

Degree of Financial Leverage

By loaning money from the bank, you’re essentially using leverage to buy an asset — which in this case, is a house. Is an essential tool across traditional and cryptocurrency markets. It allows for better capital efficiency as traders do not have to lock up entire amounts of capital. Together with futures and options, they help introduce liquidity into the market.

Sure, you can always get a 401 loan, a HELOC, or a hard-money loan; however, nothing to which you can get access will be without cost. Let’s forgo for now discussions of leveraged ETFs, options, futures, and margin trading and look at a realistic leverage scenario in which most of us will find ourselves. You have a home equity loan or home equity line of credit . Similar to the mortgage, this is also borrowing against your home, ostensibly for needed repairs or renovations. Similar to mortgages, you can deduct HEL/HELOC interest on your taxes as long as you’re using it to repair or remodel your home. This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. If you want to short a stock, there are borrow fees AND the margin rate.

Is Rapid Growth Good for Business?

The average U.S. household carries over $155,000 in debt.1 Depending on how and why you’re borrowing, however, debt can be useful. A strategic use of debt may help you achieve your short- and long-term financial goals. A higher value of leverage signifies that is leverage good or bad a company has more debt than equity. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

It’s important to note that on most days, major indexes, like the S&P 500, move less than 1% in either direction, meaning you generally won’t see huge gains or losses with this kind of fund. Businesses use leverage to launch new projects, finance the purchase of inventory and expand their operations. And if you’re leverage trading, you need some good ones.

Where shareholder equity equals total assets minus total liabilities. For institutional investors, the median profit after fees is not a profit at all but a loss of 19,000 Yuan ($2,973). For individual investors, it is a somewhat smaller loss of 14,000 Yuan ($2,191). Individual investors lose not because they are better investors, but because their trades are smaller. While leverage can increase one’s https://personal-accounting.org/ return, it can also increase the losses of an investment. Understanding the risks involved can help you decide whether using leverage is the right choice for you and your finances, and for what types of investments. “While it increases the buying power of an investor by allowing them to make increased gains with the use of more buying power, it also increases the risk of having to cover the loan.”

What is the downside to leverage?

Using leverage can result in much higher downside risk, sometimes resulting in losses greater than your initial capital investment. On top of that, brokers and contract traders will charge fees, premiums, and margin rates. Even if you lose on your trade, you'll still be on the hook for extra charges.

The key is to use leverage wisely and ensure that what you’re buying will build wealth. The Moore family has total household debt of $368,000 ($350,000 mortgage, $10,000 in car loans and $8,000 in other debt). Their home is currently worth $1 million and their two cars are worth $15,000 each. After expenses and debt payments, the Moore family has $150,000 in disposable income per year. Their debt-to-assets ratio is calculated as 36% ($368,000 / $1,030,000 x 100%). Their consumer leverage ratio is calculated as 2.45 ($368,000 / $150,000). For many businesses, borrowing money can be more advantageous than using equity or selling assets to finance transactions.