agency credit memo Wiktionary

Contents:

The item may be defective, the wrong size, or the wrong color or perhaps the buyer just changed his or her mind regarding the purchase. A price change is another reason why a seller may issue a credit memo. For instance, a buyer may purchase a product one day before its price is marked down 30 percent. The seller agrees to issue a credit memo for the difference between the price the buyer paid and the new sale price. Credit Terms Notwithstanding Section 3.2, above, Station may grant credit terms to Advertiser, subject to Station’s completion of a satisfactory credit check. If Station has granted Advertiser credit terms, payment is due within thirty days of invoice date.

But all thanks to InvoiceOwl which allows creating credit memos in just a few seconds, so businesses can save time and focus on other areas of the business. Without giving it a second thought, start your FREE trial with us and explore all the features and functionalities of the software. In the case of a gift certificate, the amount presumed abandoned is the price paid by the purchaser for the gift certificate. In the case of a credit memo, the amount presumed abandoned is the amount credited to the recipient of the memo. A credit memo must be entered in the payment system directly against the original purchase order.

Credit Memorandum Example

During financial transactions, you might need to provide credit to the customers for accommodating situations where goods are returned, there is a pricing dispute or where the buyer is not required to pay the full amount of the invoice. In such cases, you can issue a Credit Memo to store the credit balance and offset it against a transaction. Business TransactionA business transaction is the exchange of goods or services for cash with third parties (such as customers, vendors, etc.). The goods involved have monetary and tangible economic value, which may be recorded and presented in the company’s financial statements.

It is a document prepared to adjust the errors made in the sales invoice, which has already been processed and sent to the customer. Usually, it comes into the picture if the client has paid more or less than the actual price of the goods or services taken. The seller will inform the buyer how much extra he has paid in the document, and he can keep the count during the next transaction.

How to create a purchase credit memo in Business Central?

Merchant is solely responsible for ensuring that it is permitted by federal law, state law and the Card Brand rules to impose a surcharge. Merchant may be required to provide notification to the Card Brands if it imposes a surcharge and hereby authorizes Servicer to provide such notification and furnish any necessary documentation, on Merchant’s behalf, to the Card Brands. However, Merchant may not, by this term, be prevented from offering discounts to Cardholders for cash purchases. To use a credit memo, businesses will need to generate a new document and fill in the required information.

Second, they can help streamline the accounts receivable process by reducing the number of invoices that need to be processed. Finally, credit memos can provide documentation for accounting purposes. A credit memo is a refund document that is typically issued by a seller to a buyer. This memo acknowledges that the buyer has returned merchandise or services and outlines the terms of the refund. Credit memos are also used to correct errors on previous invoices, such as when incorrect items were shipped or when prices were overstated.

AccountingTools

He is the sole author of all the materials on AccountingCoach.com. Now, last but not least is understanding how to prepare a credit memo. Receipt Maker Generate receipts within seconds through this invoicing software.

Overall, it can be concluded that a credit memo, when used, makes the backtracking of a particular product’s discount history easy for the seller. The seller will increase or decrease his receivables, depending on the total amount. If your buyer’s already paid the full invoice amount, they have two options. Either they can use the credit memorandum on future payments or receive the difference between the credit memo and the original invoice as a cash payment. For instance, if the credit memo reduces the original invoice by $35, the customer can request the $35 credit in cash.

Credit memorandums for returned goods

The long term liabilities examples also considers the ethical trust between the two parties in the business. The buyer has a new requirement for the same shipment from the same seller. This is not intended as legal advice; for more information, please click here.

What if India had 75 states? Demands for redrawing state lines call for a permanent SRC – ThePrint

What if India had 75 states? Demands for redrawing state lines call for a permanent SRC.

Posted: Tue, 18 Apr 2023 05:24:50 GMT [source]

If you receive a credit memo from a vendor, it means that the vendor has issued a credit to your account. This happens when you return merchandise to the vendor or when the vendor owes you a refund for some other reason. To create a credit memo, businesses first need to generate an invoice for the customer in question. Once the invoice has been generated, businesses can then begin the process of creating the credit memo. A gift certificate or a credit memo issued in the ordinary course of an issuer’s business which remains unclaimed by the owner for more than three years after becoming payable or distributable is presumed abandoned. In the event the purchase did not occur through the payment system via a purchase order, the department must create a non-po payment/credit request.

Also, a credit memo assumed by inexperience can create a problem in the existing balance sheet. If this is enabled by invoicing software, it reduces the aggregate dollar amount following the number of invoices outstanding. Credit Memoranda You will issue a credit memorandum, instead of making a cash advance, a disbursement or a cash refund on any Card transaction. Member Bank will debit the Merchant Account for the total face amount of each credit memorandum submitted to Processor. You will not submit a credit relating to any Sales Draft not originally submitted to Processor, nor will you submit a credit that exceeds the amount of the original Sales Draft. You will, within the time period specified by applicable law, provide Processor with a credit memorandum or credit statement for every return of goods or forgiveness of debt for services which were the subject of a Card transaction.

A Private Real Estate Investment Update: My CityVest DLP Access … – The White Coat Investor

A Private Real Estate Investment Update: My CityVest DLP Access ….

Posted: Wed, 19 Apr 2023 06:47:08 GMT [source]

Multi-Company Manage up to five companies in your existing InvoiceOwl account and streamline all your businesses. CREDIT MEMO.From and after the date ninety days following the Closing Date, Parent shall issue each Credit Memo within sixty days following the end of the month to which such Credit Memo relates. Certain information contained in the video constitutes “forward-looking statements,” which can be identified by the use of terms such as “may,” “will,” “expects,” “intends,” “plans,” “believes,” “estimates” or comparable terminology. Mr. Johnson is now a training professional in the industry leading various banking seminars, both within the US and internationally. He teaches actively for twenty-two state banking associations and community banking associations in the United States, and for the Risk Management Association and individual banks nationwide.

- The detailing and particulars in the credit memo make it significant, hence the usage of the same universal and globally accepted across all sectors and industries.

- Notwithstanding the foregoing, Station reserves the right to revoke Advertiser’s credit in the event Station reasonably determines that Advertiser is no longer creditworthy.

- The credit memo or credit memorandums are issued after the buyer sent the invoice to the seller and reduces the original purchased price under buyer records.

- Many vendors submit credit memos to balance their accounts receivable, and the credit memo is for information only and should be retained in unit files.

Meet with management armed with relevant questions and issues to be addressed. They provide information on the condition and status of a customer relationship. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. It decreased the number of journal entries in the account, making it easy to track and report. It is nothing but the invoice receipt of sale but in the exact opposite direction in terms of the book of accounts. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

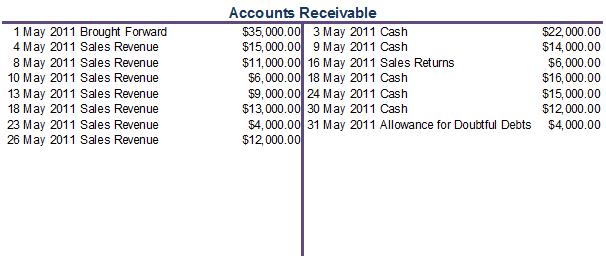

These prices are much lower than the past due to a drop in the market price for stuffing. Therefore Cindy sends a credit memo form to Toys N’ More informing them that they should reduce the amount that they owe to Fluffy Stuffs. Fluffy Stuffs will also reduce its accounts receivable by the same amount. Most credit memos are issued under the circumstances of owed, accounts payable, and reduce payments. Credit Line If your application is approved by us, this agreement will constitute a revolving line of credit for an amount which will be the credit line under your Account.

Penn State and Taipei Tech sign memorandums of understanding – psu.edu

Penn State and Taipei Tech sign memorandums of understanding.

Posted: Mon, 14 Nov 2022 08:00:00 GMT [source]

For example, Cindy works for Fluffy Stuffs Inc. as a part of its sales staff. The company has recently sent an order to Toys N’ More for a price based upon last month’s prices. Cindy just received the new prices the sales staff is supposed to charge customers.

Credit memos are a common feature of the business world, and yet, despite their prevalence, many people aren’t aware of what they are or how to use them. For businesses, credit memos can be particularly useful for smooth operations and managing customer relations. In this article, we’ll discuss what credit memos are, why you should use them, and how to make sure you’re including all the necessary information. With this knowledge in hand, you’ll have a better understanding of how credit memos work and be better prepared to manage your finances.