Best Online Brokers For Beginners In May 2023

The best trading platforms in the UK provide the tools and support for each type of trader. Maintenance fees are charged regardless of your activity in the account. Inactivity fees are charged as a way of earning revenue from customers who didn’t trade in a given month – something that may be more likely for some newer investors. Fortunately, most online brokers do not charge maintenance or inactivity fees, but those who do have these fees charge as much as $99.95 per month.

Both TD Ameritrade’s website and mobile apps are secure and user-friendly — both offer the ability to execute trades, access educational tools and receive a managed portfolio recommendation. Customers can reach customer service via a 24/7 hotline, in-person branches, text and direct messaging online. $0.00 commission applies to online U.S. equity trades, exchange-traded funds (ETFs), and options (+ $0.65 per contract fee) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients.

Best Online Brokerages of May 2023

A simple and easy way to diversify your portfolio is to invest in mutual funds and ETFs. A mutual fund offers a way to invest in many stocks or bonds at once by pooling your money with other investors. Others are “index funds” that merely aim to deliver market-matching returns. Either way, mutual funds offer a simple way to diversify since all your money isn’t held in a single company’s stock. Zero account minimums and zero account fees apply to retail brokerage accounts only.

Investors can get a lot of value out of its features such as high quality research, trading tools and guidance on building an investment portfolio. Schwab’s low-cost ETF and index investing is one of the largest in the market. Investors big on mutual funds can leverage the platform’s diverse list of OneSource no-commission, no-load mutual funds and Schwab’s branded low-cost mutual funds.

Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Duly regulated online brokers like those listed above are insured by the Securities Investor Protection Corp. (SIPC) that protects assets held with the broker up to $500,000, including $250,000 held in cash. There are discounts available to active traders, and the customer service team is very responsive. Try a Pro, Web or Mobile account, and use the built-in scanners, custom alerts and short locates tools so that you can make wise decisions and stay on top of your portfolio.

Which trading platform is best for beginners?

Many online brokers allow for small minimum deposits which can be a great alternative for those with limited funds. Account minimums (if any) are displayed at the top of our reviews, as well as in our selection of the best platforms for different types of investors. If you are looking for more general guidance on investing with limited capital, check out our article on smart investing on a small budget. International traders can access financial markets and all assets on the desktop, web, and mobile versions including both IBKR Mobile and the IBKR GlobalTrader app.

Best Ways to Earn Passive Income in 2023 – Investopedia

Best Ways to Earn Passive Income in 2023.

Posted: Tue, 18 Apr 2023 07:00:00 GMT [source]

Dealing UK stocks costs £2.75 per deal, while US stocks cost €1 (~ £0.90) per trade. DEGIRO does not offer an ISA or SIPP.DEGIRO is suitable for beginners and advanced investors, and you can access the platform on any device via the web portal or mobile app. DEGIRO currently has over two million customers across 18 countries.Capital at risk.

Ally Invest

When you buy UK shares electronically, you will pay a 0.5% Stamp Duty Reserve Tax (SDRT) to the government. This type of analysis should form the basis behind every stock you choose to invest in. A thoughtful investor has a “story” that explains every decision behind a stock pick. Twitter accounts and popular trading blogs such as @WatcherGuru, @unusual_whales, and @MarketWatch are also very helpful. Using the S&P 500 as a benchmark for the stock market’s overall performance, we can see that it enjoyed significant growth in the ten years leading to 2020. Always remember that investments can go down as well as up in value, so you could get back less than you put in.

With a long and growing list of available options, it can be daunting to find the right brokerage platform that meets your needs. When you’re a beginner investor, the right broker can be so much more than simply a platform for placing trades. It can help you build a solid investing foundation — functioning as a teacher, advisor and investment analyst — and serve as a lifelong portfolio co-pilot as your skills and strategy mature.

The research resources here are deep, with a variety of reports available. You can attend webinars or view recorded ones that cover almost any area of investing, so you’ll be knowledgeable in no time. Bankrate follows a strict

editorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

#10 Best online broker for investors

However, the performance of an investment portfolio could be volatile, i.e., experiencing both negative and positive returns periodically. Another misconception about investing is that anyone who invests in financial markets will become rich quickly. A third misconception could be that investing is trading, which is not the case. Whether you’re looking for a great trading platform, low commissions or helpful customer support, Fidelity will do right by you.

- The six categories we tested were commissions and fees, platform and technology, range of product offerings, research and education, account security and customer service.

- Finally, keep an eye out for promotions and bonuses—many leading brokers offer account bonuses based on the size of your initial deposit.

- High fees might be worth it if they are accompanied by personalized service that helps you meet your investment goals.

- Finally, both eToro and Interactive Investor provide a demo account with virtual funds, which can be helpful for beginners who are not yet confident enough to trade with real money.

Any of these online stock brokers could be a great fit for your investing and trading goals. To trade stocks in the UK, you need to open a stock trading account with a trading platform or stockbroker. https://trading-market.org/ The best trading platforms in the UK will allow you to trade shares via an Individual Savings Account (ISA), General Investment Account (GIA) or Self-Invested Personal Pension (SIPP).

This brokerage is good for traders who want a wide range of assets to choose from. Interactive Brokers scored the top spot on our list for offering the most expansive list of products compared to other online brokerages we ranked and of course for its zero-dollar account minimum and stock trading fee. It also offers margin trading and several educational resources in the form of webinars, podcasts, learning labs, and more to help investors learn about trading and the financial markets. An online brokerage account is a portfolio of cash and securities on an online trading platform.

Fidelity may be the most investor-friendly broker out there, making it a top choice for beginners. This broker offers it all and does it at a high level, with remarkable customer service, too, especially by phone, where you can get an answer to your detailed question in seconds. In addition, the company introduced the Fidelity Crypto Industry and Digital Payments ETF (FDIG), along with a Fidelity Metaverse ETF (FMET). Enhancements also came to the institutional side of the business, with the company expanding access to some of its proprietary tools, like Fidelity Bond Beacon.

This year, we revamped the review process by conducting an extensive survey of customers that are actively looking to start trading and investing with an online broker. When choosing an online broker, you have to think about your immediate needs as an investor or trader. If you are a beginner, you may need a broker who has great educational material about the stock market and other financial markets. This is one of best online investors the key reasons TD Ameritrade is our top pick for beginners. A number of brokers also allow for paper trading prior to funding an account, giving you an opportunity to learn the platform, sample the available assets, and test out the trading experience without risking real capital. All of the leading online brokers today offer free stock trading and zero commissions on buying and selling many other types of assets.

Interactive Brokers facilitates trading and investing across asset classes in over 150 international markets. As of September 30, 2022, the platform has approximately 2.01 million customer accounts and client equity worth $287.10 billion. The platform features individual investment and professional accounts for businesses and institutional investors.

This can represent a low-cost way to access everything from

conservative funds to speculative investments. If you want to invest in stock markets outside the US, look for a broker that provides international market investment options at attractive brokerage fees. Online brokers often provide add-on services, such as investment in international markets, paper trading tools, and curated research newsletters. Depending on your investing style, you should look into the additional benefits offered to reap maximum benefits from your broker.

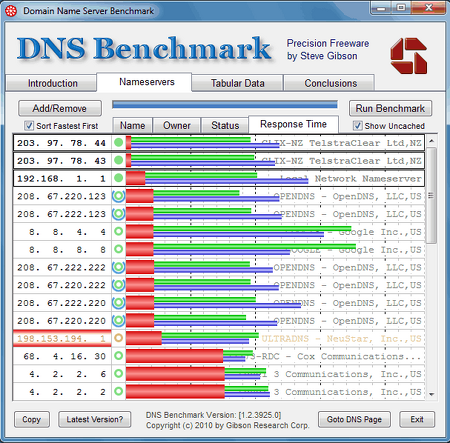

What is the fastest online stock broker?

The fastest trading platform will be found among TradeStation, tastytrade, TD Ameritrade thinkorswim, Interactive Brokers' Trader Workstation (TWS), and Webull because they are desktop-based.

Schwab also provides the benefits of an extensive branch network across the United States, where clients can schedule one-on-one sessions with a financial professional. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. For more details about the categories considered when rating brokers and our process, read our full methodology. We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The final output produces star ratings from poor (one star) to excellent (five stars). People often identify opening a savings account as their next money move.

Who is an online investor?

Online investing is the act of traders and investors using online services and trading platforms offered by brokers. Online investing is more self-directed than traditional investing.