What Is an Outstanding Check? Outstanding Checks 101

Contents:

An NSF fee or non-sufficient funds fee is incurred when a bank account does not have enough money to cover a payment. Outstanding checks that remain so for a long period of time are known as stale checks. An outstanding check is a financial instrument that has not yet been deposited or cashed by the recipient. A cashier’s check is guaranteed by the banking institution and signed by a bank cashier, which means the bank is responsible for the funds. This type of check is often required in large transactions, such as buying a car or house.

Outstanding deposits refer to a deposit that has been made but has yet to clear in the recipient’s account. Unlike a check, deposits have already been received by the bank and are being processed. Different banks have different processing times, but most outstanding deposits typically clear within three business days.

They are revenue to the payees which would be deposited immediately. The management had already allowed the payment, though not yet deducted from the bank balance. This is why your bank accounts need to be reconciled with the bank statement. There is a discrepancy between what your checkbook or accounting system says you have in your account and what the bank reports on your monthly statement.

How Checks Work

Some average collection period formulas become stale if dated after 60 or 90 days, while others become void after six months. One of the ways of making payment for a transaction is by check. A check is a financial instrument that authorizes a bank to transfer funds from the payor’s account to the payee’s account.

Hence, notifying the payee could remind them about depositing the check. An outstanding check is a liability for the person (i.e., payor) who has written the check. They must make sure that enough money remains in their checking account to cover the check until it is paid.

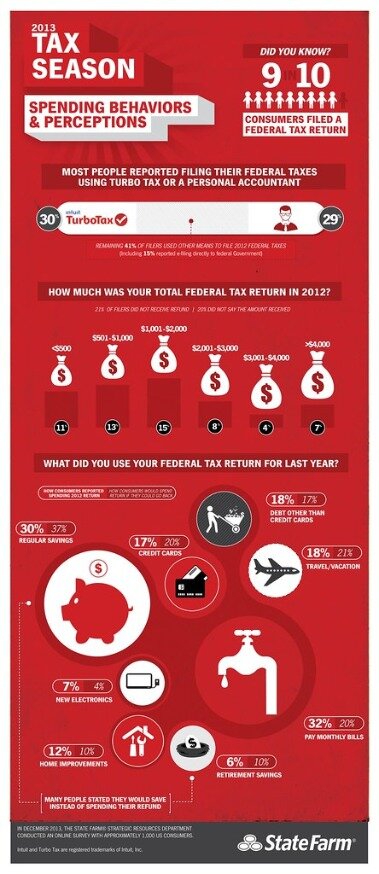

Balancing your checkbook is akin to what professional accountants do during reconciliation. It’s a way of making sure that you and your bank agree about your account balance and available funds. It can be tricky to balance a checkbookand we have a worksheet with step-by-step instructions to help you. Individuals need to account for outstanding checks when they balance their checkbooks. When you write a personal check, you should record the date, check number, payee, and amount in your check register. This is very important because your bank balance will be higher than your available funds until the check clears the bank.

What happens to an uncashed personal check?

The payor can void these fees using overdraft protection on their checking account. An outstanding check is a check payment that has been recorded by the issuing entity, but which has not yet cleared its bank account as a deduction from its cash balance. The concept is used in the derivation of the month-end bank reconciliation.

Regions Financial Q1 Highlights: 22% Revenue Growth, Earnings Miss, Solid Net Interest Income & More – Yahoo Finance

Regions Financial Q1 Highlights: 22% Revenue Growth, Earnings Miss, Solid Net Interest Income & More.

Posted: Fri, 21 Apr 2023 13:20:45 GMT [source]

Most banks will continue to honor checks for the full 180 days, but that isn’t guaranteed. To prevent problems, you should cash or deposit a check promptly after receiving it. If you write a check and the money never leaves your account, you may develop the false belief you can spend those funds, but the money still belongs to the payee. If the payee finally deposits the check after months of delay, you riskoverdrawing your account and bouncing the check. If an outstanding check of the previous month clears the bank, it means the bank paid the check and the check will appear as a deduction on the statement.

Bank Reconciliation Statement

If this goes on long enough, the money order will be worthless. U.S.P.S. money orders do not expire and retain their value indefinitely. As long as there are post offices, you can cash a U.S.P.S. money order. Treasury checks are good for one year after the date on the check. This means that federal tax refund checks are good for one year as those are issued by the U.S. After that time, you’re still entitled to money the government owes you, but you’ll need to contact the issuer of the check and request a new check.

An outstanding check represents a liability for the payor. Approved checks at the end of the month could remain unreleased. Indeed, a company typically does not have assigned personnel just for check deliveries.

Accounting for Outstanding Checks on Balance Sheet: Definitive Guide

Outstanding checks are deposited into a bank account once they are deposited by the recipient and processed by the receiving bank. Unfortunately, the issuing individual or business does not have any way to force a check to be deposited. We will also answer a few important questions and compare outstanding checks to outstanding deposits. When you receive a check from a governmental agency, read the check and look for anything that tells you when it expires. The best bet is to deposit or cash the check before the expiration date. Some businesses print “Void after 90 days” on their checks to encourage recipients to deposit checks more promptly.

- The payor is the entity who writes the check, while the payee is the person or institution to whom it is written.

- Nowadays, many companies use specialized accounting software in bank reconciliation to reduce the amount of work and adjustments required and to enable real-time updates.

- The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

- If you have an expired state tax refund check, you should contact the state and request a new check.

Below is a video explanation of the bank reconciliation concept and procedure, as well as an example to help you have a better grasp of the calculation of cash balance. After reconciliation, the adjusted bank balance should match with the company’s ending adjusted cash balance. Types of checks include certified checks, cashier’s checks, and payroll checks, also called paychecks. If a payee receives a check and does not present it for payment at once, there is a risk that the payer will close the bank account on which the check was drawn. If so, the payee will need to receive a replacement payment from the payer.

Why Outstanding Checks Matter

To account for outstanding checks on a balance sheet, monitor them every month to assess their validity. For example, they should be reviewed regularly to see whether they are recorded in the right bank account. The recording of check issuance may be erroneously recorded in another bank account.

A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Company

It typically occurs in an entity with thousands of disbursed checks. Also, when a check is journalized in the incorrect bank account, it will remain outstanding, unless an adjusting entry is made. Furthermore, when the check clears, it will be an unrecorded transaction on the correct bank account. Thus, errors in recording checks increase the outstanding checks of another bank account. This post will show the accounting for outstanding checks on the balance sheet. Then, it will show why adjustments are not needed because outstanding checks usually appear in a bank reconciliation statement.

Also, disbursements can remain outstanding at the end of the month. These can be outstanding checks that are identified in the bank reconciliation statement. If the payee doesn’t deposit the check right away, it becomes an outstanding check.

If the outstanding check has expired, you may want to write another check; however, it’s possible that this check will go stale, too, and that would prolong the situation. When you ask them how they want to be paid, try suggesting a money order, cashier’s check, or cash. You can ask if they’re willing to deduct the stop payment fee from the original amount. We will assume that an outstanding check has appeared on the outstanding check list that is part of the company’s bank reconciliation for at least four months. In other words, the company issued the check more than four months earlier and the check has not yet cleared the company’s bank account. This should provide real-time information about the total dollar amount of checks outstanding and the total dollar balance present in the account.

They may have forgotten about the checks or they have not scheduled when to deposit their collections. Notably, the checks may have been lost by the suppliers. An outstanding check represents a check that hasn’t been cashed or deposited by the recipient or payee.

Alternatively, if you both use the same bank or credit union, the transaction will conclude when the money is transferred from your account into the payee’s account. This statement is used by auditors to perform the company’s year-end auditing. Forgotten outstanding checks are a common source of bank overdrafts. One way to avoid this occurrence is to maintain a balanced checkbook.

Auburn man among game wardens honored at banquet – Lewiston Sun Journal

Auburn man among game wardens honored at banquet.

Posted: Fri, 21 Apr 2023 21:35:59 GMT [source]

The payee may cash the check immediately or might hold onto it for months. Checks that remain uncashed for long periods of time are called stale checks. Conversely, outstanding checks are usually adjusted in the accounting records quickly when there are accounting errors. Stale checks are uncashed checks that are already six months old. They are usually adjusted, deducted from the cash balance, and credited to accounts payable. In addition, some outstanding checks were inadvertently recorded to another bank account instead of the right account.

The cost could become enormous which a company would avoid. In addition, check recipients often must do follow-ups and not the issuer. This is logical because a company will usually do its best to defer payments to suppliers and contractors. Also, checks released on the last bank day are usually deposited on the next ensuing month. Hence, approved but unreleased checks are normal each month.