What is Scalping Trading?

Contents

However, this is a risky strategy as it is tough to predict crypto price movements and borrowing funds to trade is always risky. Scalp traders using this technique usually set very tight stop losses to limit potential losses. Another variation of the bid-ask strategy is arbitrage trading. Here, traders take advantage of the price difference between exchanges and trading platforms to book profits. And again, this is most efficiently done by trading bots that can execute the positions quickly and book profits before prices fluctuate.

Investors purchase securities having a high potential for growth in the future, but the prices are suppressed due to market fluctuations. Relative or absolute momentum investment strategies can be implemented, wherein stocks of companies underperforming either in a relative or absolute sense can be chosen. Generally, brokerage fees on intraday trading stocks are one-tenth of what is levied if standard trading is undertaken.

Customers who read this book also read

It is calculated by adding the closing prices in the desired time frame, and then dividing the number by the number of periods. Scalpers are of the belief that it is easier to make small profits off the market since there is a lot of volatility and can’t afford to take too much risk. They grab small moments when there is a profitable trade before it vanishes. Unlike many who buy shares for the long term, these guys rely on trading within minutes.

The profit at one point went up to 35,000 or something, but by the time I got my order executed, it inverted. You can see right here and the profits were coming to my range. I just wanted to give a little bit more timing that the bounce was looking decent enough that it was, the level was holding. https://1investing.in/ I just waited for a little bit longer and then I placed my exit order. And even there at one point, my profit went up to about 36,000 rupees, which I was not able to grasp. The moment bank nifty came down to the critical support that I was watching out for, I wanted to go for a bounce.

Since cryptocurrencies are highly volatile, there are plenty of price movements daily. Traders use technical indicators to place extremely short-term trades to make quick profits. The timeframe for these trades can be hours, minutes or even less. Therefore, compared to day traders, who usually make around ten trades a month, scalp traders can make upwards of 100 trades during the same period. New traders are often confused which trading style to pursue. If you too have the same dilemma, you have come to the right place.

Master Certain Strategies

Their exit from the market is pre-planned since they trade in such a way that a single loss can eliminate all their small gains. Some traders utilise technical indicators to predict potential price movements and execute scalp trades. If they are confident in their predictions, they can also use margin funds to increase the size of their position and maximise gains.

- Cryptocurrencies tend to come out with high levels of volatility.

- However, all the apps are having the basic features required for scalping that are quick order execution, fast order placement, and analytical tools.

- I modified the order and it got executed this time, and now you can see the penal fluctuation.

- Thus, it is imperative for traders, especially beginner traders to understand the nitty-gritty of such trading technique to avoid any losses.

As a scalper, you are not provided with this facility most of the time, so closing the position with inconsiderable losses is a great idea. In order to make scalp trade, you should lessen the number of trades in a single day so that your margin requirement and risks are also reduced. Check your securities/mutual funds/bonds in the Consolidated Account Statement issued by NSDL/CDSL every month. Stockbrokers can accept securities as margin from their clients only by way of a pledge in the depository system w.e.f. 1st September 2020. – Invest in mutual funds and manage your portfolio from one place in the CapitPlan app in Android or iOS.

A positional or a swing trader has to do an in-depth analyse of the stock and has to come to conclusion. Intraday trading can be undertaken depending upon an investor’s knowledge about the stock market. Individuals who do not possess such extensive information can research online about the same before embarking on such investments. However, such trading has to be done through a brokerage firm, wherein the percentages of total profits are deducted as payments.

It is because of the fact that scalping requires frequent trade orders and execution. Under this trading method, individuals can invest in stocks of different companies. It is generally undertaken for a more extended period, wherein investors can profit from both capital appreciation and periodic dividend payments.

The goal of stock trading is to generate income or capital appreciation. Trading in Indian stock markets got promoted in the year 2001 since the launch of derivative segment which comprises futures and options (F&O) contracts. Over the years, we have witnessed the trading community evolve as new technologies are introduced and new styles of trading emerges.

Quick Links

Scalp Pro is a scalping tool that uses the MACD mechanism. MACD lines are smoothed using fibonacci numbers and pi numbers. A ” BUY ” signal is generated when the lines cross upwards. If the lines cross down, a ” SELL ” signal is generated. The logic is very simple and the Indicator is very useful.

It can be done in any securities and commodities as well. So to conclude, If you are a trader in the market and want to try out a new strategy, you can try scalping. It can be turned into a primary or a supplementary style. Be wary of the fees – Trading fees are often very minuscule.

Scalping Trading refers to a trading strategy that aims at leveraging minor to small fluctuations in a security’s price. The traders who use the scalping strategy places a number of trades in the market every day, which can range anywhere from 10 to 100 trades, or even more. The traders who use the Scalping Trading Strategy are often called scalpers.

Day trading and scalping, in particular, is one way a trader can tighten their belt and take advantage of every slight movement in the markets despite the times. So if you pay close attention to signals in the market, know what they mean, and act fast. You will be well on your way to scalping out of the next recession. Furthermore, market conditions may not always be ideal, and sometimes you’re expected to make a profit in harsh bear conditions such as a recession. While different strategies can work sometimes, an excellent one is the scalping technique, but that’s only if you know how it works. One must not confuse Scalping Trading with Intraday trading as they are quite distinct trading strategies.

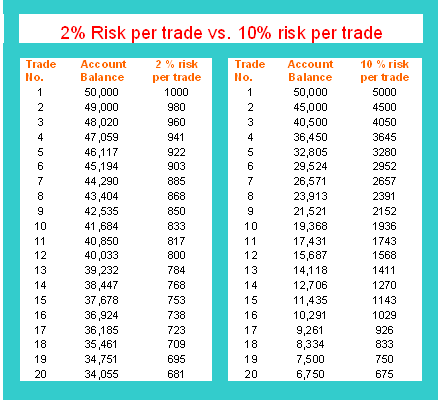

As an illustration, no tested strategy guarantees success in at least 90% of scalp trading scenarios. Scalpers look for different liquid markets to increase the frequency of their trades, but because the profits from each transaction are so little, they do so. Account equity for scaling must be more than the minimum $25,000 necessary to adhere to the pattern day trader guideline. With the aid of price chart indicators such as pivot points, Bollinger bands, and moving averages, price support and resistance levels are identified. Having a shorter market exposure reduces the likelihood of encountering a situation that may hinder your scalp trading. Success in scalp trading is not difficult if you have certain traits and use the proper indicators.

Intraday Trading – FAQs

To route orders to the most liquid market makers and ECNs for rapid execution, they frequently use Level 2 and time of sales windows. The concept of scalp trading revolves around three principles. You should invest in assets that have high volatility and experience daily price swings. An investor sells and buys the stock simultaneously by posting a bid and an offer. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. If you’re considering scalping, please make sure that you have the right kind of bandwidth and you have the right kind of infrastructure to be able to do Scalping effectively.

We believe that the proper knowledge shared with the users will be a successful marketing option; it brings the potential audience to learn more about trading. We feel privileged to make more content videos to help every user learn and earn more. Scalpers look for minute changes in asset prices to take advantage of, even when the market is quiet. The SAR scalping indicator functions best when markets show consistent tendencies.

You can just check the live market streaming on the mobile application as well. This platform offers level 2 quotations as well for your scalping requirement. It is having one of the most advanced trading apps and terminals which can boost your scalping skills. Now we all know that Kite is one of the super-popular trading applications in the Indian stock market at present. However, before getting into the rankings and the trading applications, let us know the basic of scalping apps and the features which are required by the scalpers to scalp successfully. This is a simple scalping strategy that works for all time frames…

Most Commonly used Scalping Indicators

Systematic scalping makes trades more objective by removing human bias from trading decisions. Focusing on charts with shorter periods, such as the one-minute and five-minute candlestick option type charts, is therefore necessary. It is usual to practice utilizing momentum indicators like stochastic, moving average convergence divergence , and the relative strength index .

Thanks to the high frequency of trades, these small profits can add up to sizeable gains over time. A scalping strategy employs a very short holding period for positions. The holding period for a scalper may be as little as a second, and is up to few minutes. Scalping could be for taking a profit spread for a few basis points. If the liquidity is strong scalping could be done for gaining couple of points, this usually happens in a secular bull market. In very simple terms, scalping is a very fast form of intraday trading where traders get in and out of the trades within a few minutes or seconds.